What’s Behind The Numbers? Stock Grader (TM)

What’s Behind the Numbers? STOCK GRADER TM is a risk management App

for investors in the largest 750 US listed stocks.

FUNCTIONALITY

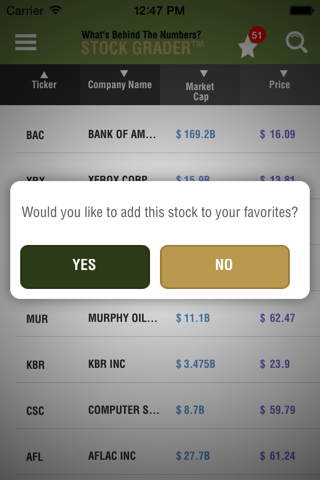

The User inputs ticker symbols for favorite stocks, the maximum number

determined by subscription level. The App assigns letter grades and number

rank. The User then knows how each stock ranks A+ (offers less risk according to the criteria) to F (offering the most risk) overall against the other 750. The App also ranks each stock against all the others in the 750 stock universe, from 1 (offering least risk) to 750 (offering most risk),according to where it scores on the letter grades.

The App updates the 750-stock database monthly and the User’s Favorites

list is automatically updated at that time. The User will see the information

quickly and easily for their entire “My Favorites” list as well as each favorite

individually.

FEATURES

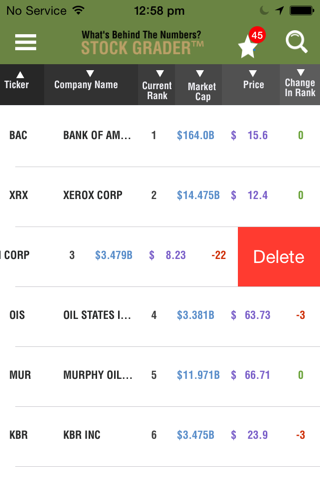

The My Favorites screen provides each stock’s ticker, name, numerical rank,

market value, stock price, and change from last month. The User may click

for each column to rank favorites alphabetically or numerically as

appropriate.

Each stock’s individual screen displays:

1.Stock ticker and company name

2.Current month’s numerical rank from 1-750

3.Change (+/-) from last month’s rank

4.Letter grades for the stock for each of the Del Vecchio Earnings Quality Index’s six factors:

Revenue, Cash Flow, Earnings Quality, Expectations, Valuation and Shareholder Yield. (A through F by quintiles)

5.Overall letter grade versus all other stocks (A+ through F by every 50

stocks)

The proprietary Del Vecchio Earnings Quality Index provides the risk grades

and ranking using financial statements analyzed according to the six factors.

The Index and “risk” are explained in Del Vecchio and Jacobs’s

What’s Behind the Numbers? A Guide to Exposing Financial Chicanery and Avoiding Huge Losses in Your Portfolio (McGraw-Hill, 2012). Risk for the Index is the probability

that a stock could face drop in price of such magnitude that an

investor could face permanent loss.

As with all investing, the future is unknown, so the grades and rankings are to help manage risk and return, but not decide it. This is not individual investment advice. It is an investing risk management tool to contribute to the greater picture.

Note: You will able to access your in-purchases using your same app credentials which youve used to purchase subscriptions on your another iOS devices.